The Central Bank of Nigeria has said

the country’s external reserves, which had faced daunting challenges since the wake of the fall in oil prices in June 2014, would grow to $40bn next year from $34.3bn as of November 3, 2017.

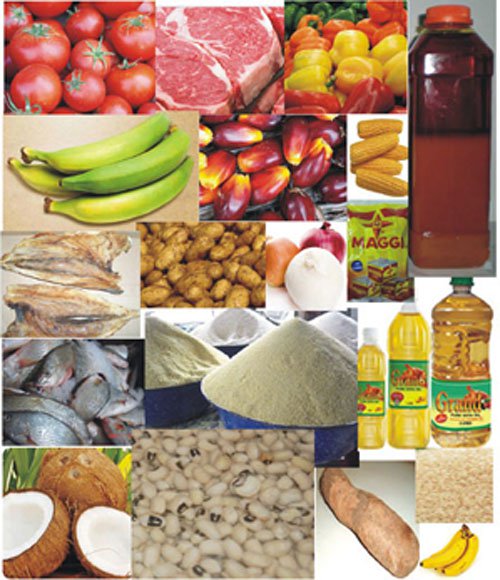

Chief of the apex bank, Mr Godwin Emefiele hinged his forecasts, which was released at the annual dinner of Chartered Institute of Bankers of Nigeria (CIBN), on the foreign exchange and exchange rate management policies of the apex bank in recent months, which has led to a drop of 65 per cent in the monthly food import bill of the country from an average of $5.5bn to $1.9bn as of June 2017.

He also said “We have also seen a significant appreciation of the naira from over N500/$1 to about N360/$1. In addition, we have seen stability in the rate for over six months now. I am glad to note that the exchange rate is not only stable, it is also converging across various windows and segments of the market.

“Since the establishment of the I&E Window, we have recorded about $10bn in autonomous inflows through this window alone.

“This reflects the effect of the increased transparency which that window accords the FX market and its benign impact of improving investors’ confidence and business sentiments. Our reserves have recovered significantly from a low of just over $23bn in October 2016 to over $34.3bn as of November 3, 2017.

“Today, among the benefits of that policy is the considerable decline in our import bills. From an average of about $5.5bn, our monthly import bill has fallen consistently to $2.1bn in 2016 and $1.9bn by half year 2017. This is indeed commendable.”

Mr Emefiele disclosed that the CBN may ease the benchmark interest rate come down from the current 14 per cent as this will open an avenue for more loans at lower interest rates from banks to companies.

According to him, the nation’ inflation rate might drop from the current 15.98 per cent to a single digit.

Emefiele however caitioned that although the current developments in macro-economy were welcomed, leaders and policymakers must become neither complacent nor over-confident. He said “I expect that barring any unforeseen shocks, inflationary pressure will continue to ease; I believe that it may return to very low double-digit or high single-digit levels during the next year. Though the base effect had diminished, I expect that as the socio-economic factors that are driving food inflation are resolved, the inertia therein would dissipate and the pace of headline disinflation will grow.

“Foreign exchange reserves will continue to grow. Over the last 12 months, Nigeria’s FX reserves grew by over $10bn from just over $23bn in October 2016 to over $33bn in October 2017. It is my belief that if we remain resolute with our efforts, policies and actions, we can attain an FX reserve position of about $40bn by end 2018.

“Exchange rate stability will continue. As we entrench and sustain the transparency in the FX market, as FX reserves accretion continues, and market confidence and improved sentiments remain, I expect that the exchange rate will not only be stable but would begin to appreciate against major currencies.

“The adverse competitiveness outcome, which such appreciation may entail, would be adequately mitigated by proactive policies to ensure that our balance of payments position is not undermined.

“Monetary policy stance could change when the underlying fundamentals become supportive. If the pace of disinflation becomes adequate and we see inflation at predicted levels, I am very optimistic that MPC may begin to see strong justification for an easing of monetary policy, which may further accelerate the recovery process.”