BY WALE BOLORUNDURO

THIS first model was adopted by Osun during the tenure of Ogbeni Rauf Aregbesola because it gradually increased debt service capacity in line with increase in economic activities (GDP) of the state. As the state gets more effective and efficient in ring-fencing the economic activities into its Internally Generated Revenue (IGR), the funding becomes more sustainable and additional headroom is opened for further financing.

The second option is to use the total revenue over a long period of 20 years because debts for developmental projects are supposed to be on long term basis. But which of the previous years’ revenues should be adopted? Another subjective issue is what percentage of such annual revenue should be allocated to debt service? Forget about the criticism of the current Federal Government by opposition, FGN debt service has never been below 66 per cent of total revenue, since the day of President Goodluck Jonathan. Conservative banker’s approach is to look at a nation (sovereignty) as the highest grade with lowest risk, follow by a state (sub-national), follow by private sector and then, the individual borrowing (personal loan) as the least on the rung. If an individual is usually allowed to access personal loan by allocating one-third of its revenue to debt service, then, a state should be able to allocate half of his revenue to debt service.

So, in 2012, Osun total gross revenue was about N50bn and allocating N25bn annually to debt service, at 14 per cent interest rate, the borrowing capacity would have been about N190bn on a 20-year long term basis. Unfortunately, this approach was limited and then, there was no 20-year window in the domestic debt market for states. Not until 2015, when such long-term facility was provided by President Mohammadu Buhari-led FGN for refinancing of states debts. However, the FGN had such free access in the domestic capital market for more than 10 years and has improved the depth to a 30-year borrowing period.

In the first model, the debt capacity projected for 2014 was N160bn unlike the second model, which instantly, put the borrowing capacity at N190bn as at 2012. The second model is too bullish and it is always difficult to know what the peak annual revenue will be and when, the revenue will fall especially in an economy, like Nigeria, which is subjected to externality. The states must continue to push FGN, the regulator of capital market on effort to ensure the market is deepened for states’ financing of their developmental projects.

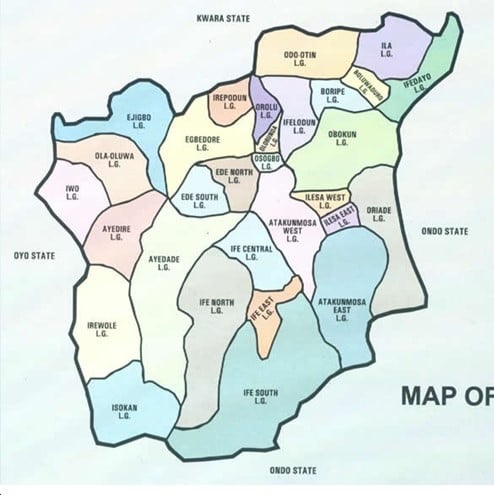

In conclusion, the global best practice has been used to model Osun financing and debt funding of the urban renewals, infrastructural developments, real sectors enabling environment that have changed the capital, Osogbo from glorified local government capital to a modern city. Yes, the model was challenged in 2015 and 2016, when the price of crude oil fell to below 30 dollars per barrel. The developmental projects and the results of impacting all sectors of the economy by Aregbesola has improved the IGR to N19bn annually, which adequately, covered the annual debt service of N18bn. With oil price at its highest in the last seven years, the monthly gross revenues of the state of Osun and local government, now totaled about N8bn monthly, while debt service remains about N1.5 bn monthly. This is the reason Chief Gboyega Oyetola said that the debt portfolio is sustainable during the 2018 governorship debate and therefore, subsequent attempt to say otherwise has been very difficult and I have assumed he has not sent anyone to say the contrary.

Concluded.

- Wale Bolorunduro, PhD, Former Commissioner of Finance, Economic Planning and Budget writes from 6B Lase Ogunleye Street, off Fadahunsi Avenue, Ilesa, State of Osun.