The Osun State Internal Revenue Service, OIRS, on Wednesday, sealed four banks in Osogbo, the state of Osun capital over their failure to meet their tax obligations totalling N72 million.

The affected banks include Diamond Bank Plc, First City Monument Bank (FCMB) and Guaranty Trust Bank (GTB) and Fidelity Bank plc.

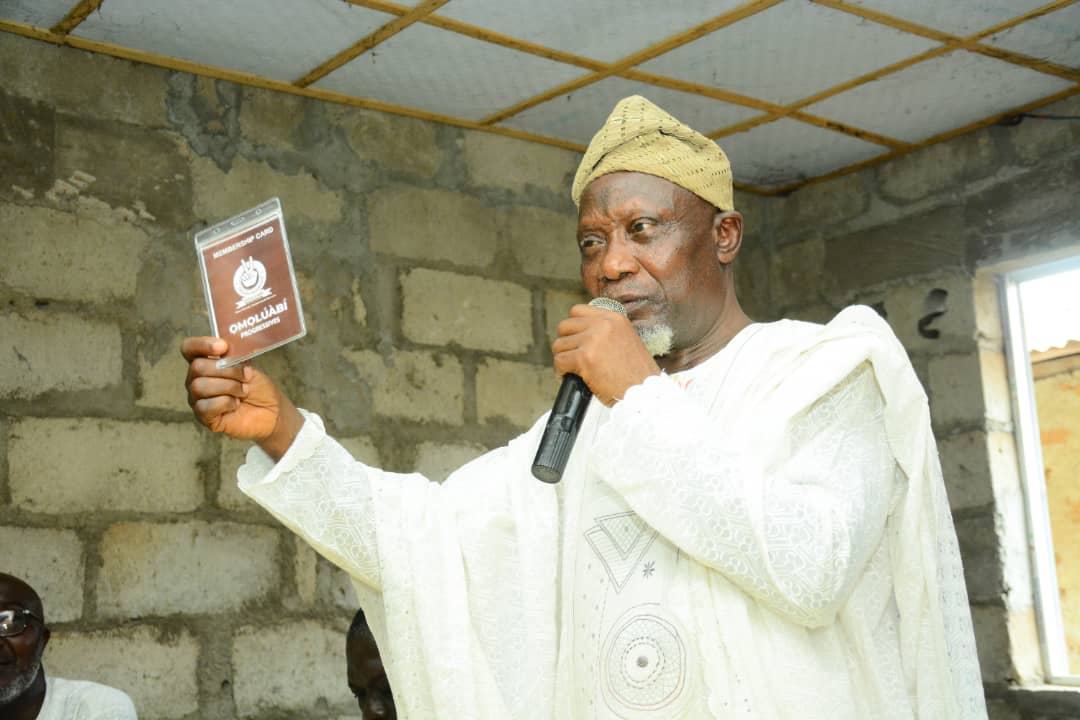

Briefing the newsmen shortly after the exercise, the Acting Chairman/Chief Executive Officer, Osun Internal Revenue Service, Mr Bicci Ali, said, the action is intended to give a bite to the financial institution’s non-compliance to remit all the outstanding taxes due to the state government.

He said as a result, the government action is in accordance to the to the provisions of Section 104 of the personal Income Tax Act 2004 LFN (as amended in 2011) and that they will not be reopened for business until all unremitted taxes are paid to the State Government.

Mr. Ali explained further that OIRS has intensified on advocacy, publicity and enlightenment programmes on the statutory obligations of the citizenry to voluntarily comply by paying their taxes, levies and other charges promptly as prescribed in the constitution of the country and the applicable tax legislations, but in spite of the efforts, many corporate organizations and individuals still engage in several violations.

According to him, under the Tax Act a taxable person is statutorily required to file a return of income tax for the preceding year at the expiration of 90 days from the commencement of every year of assessment, a taxable person or corporate organizations who have not filed their tax returns with OIRS by the stipulated date is in breach of the provisions of the law, which is an offence that is punishable under the tax laws

Investigation revealed that the exercise paralysed the affected banks’ activities as customers were seeing complaining about the development.