CBN Announces Measures To Checkmate Inflation

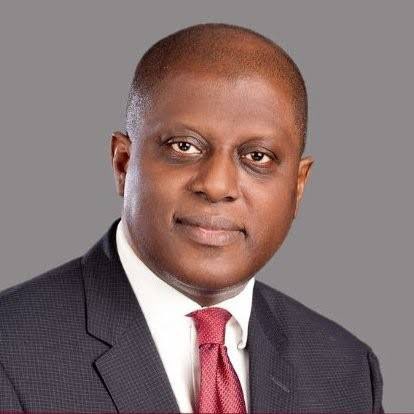

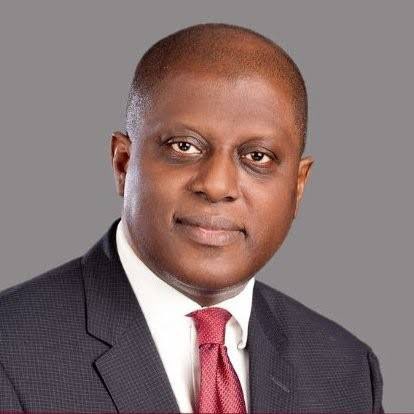

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso has said the bank will no longer grant Ways and Means to the federal government unless the outstanding balance is settled.

Cardoso also announced measures the bank was taking to tame the rising inflation in the country which has led to an astronomical increase in the prices of goods and services.

He disclosed these on Friday when he appeared before the Senate Committee on Banking, Insurance, and Other Financial Institutions alongside the Minister of Finance and Coordinating Minister for the Economy, Olawale Edun, the Minister of Budget and National Planning, Atiku Bagudu, and the Minister of Agriculture, Abubakar Kyari.

The Ways and Means had been a recurring loan the CBN issued to the federal government to finance shortfalls in the government budget.

Recall that in March 2022, the Debt Management Office (DMO) announced that the federal government had borrowed a total of N18.16 trillion from the Central Bank.

The debt as of then was more than 40 percent of the money supply in the economy.

At Friday’s meeting with lawmakers, Mr Cardoso did not state whether the federal government has surpassed the limit of advances according to the CBN Act.

But he insisted that the central bank would not be a part of the Ways and Means agreement with the federal government again the latter fails to refund all the outstanding debts on the Ways and Means already advanced.

The CBN governor said the position complies with section (38) of the CBN Act (2007).

Mr Cardoso said the payment of the outstanding balance of the Ways and Means will control inflation in the country.

“I am pleased to note the Fiscal Authorities efforts in discontinuing Ways and Means advances. This is also in compliance with Section (38) of the CBN Act (2007), the Bank is no longer at liberty to grant further Ways and Means advances to the federal government until the outstanding balance as of December 31, 2023, is fully settled. The Bank must strictly adhere to the law limiting advances under Ways and Means to 5 percent of the previous year’s revenue.

“We have also halted quasi-fiscal measures of over 10 trillion naira by the Central Bank of Nigeria under the guise of development finance interventions which hitherto contributed to flooding excess Naira and raising prices to the levels of Inflation we are grappling with today.

“The CBN’s adoption of the inflation-targeting framework involves clear communication and collaboration with fiscal authorities to achieve price stability, potentially leading to lowered policy rates, stimulating investment, and creating job opportunities.

“Our MPC meeting on the 26th and 27th of February is also expected to review the situation and take further decisions on these important issues.

“Distinguished senators, Inflationary pressures are expected to decline in 2024 due to the CBN’s inflation-targeting policy, aiming to rein in inflation to 21.4 percent in the medium term, aided by improved agricultural productivity and easing global supply chain pressures”.

Hafsoh Isiaq is a graduate of Linguistics. An avid writer committed to creative, high-quality research and news reportage. She has considerable experience in writing and reporting across a variety of platforms including print and online.