IMF Board to Promote Islamic Banking

The Executive Directors of the International Monetary Fund have adopted a proposal to promote Islamic Banking (IB) due to its popularity in the global financial system. The board, at the end of its first formal discussion on IB, adopted a set of proposals on the role the fund should play in this area.

The proposals, according to the bank, and the case for adopting them, are contained in the staff paper titled “Ensuring Financial Stability in Countries with Islamic Banking” and the accompanying country case studies paper.

A statement from the IMF said the board noted that the growth of Islamic Banking and its complexities posed new challenges and unique risks for regulatory and supervisory authorities.

“Against this background, the directors called for stronger efforts to establish a policy framework and environment that promote financial stability and sound development of Islamic Banking, particularly for countries in which Islamic Banking has become systemically important,” IMF said.

The fund said, while accounting for a small share of global financial assets, IB has established a presence in more than 60 countries and has become systemically important in 14 jurisdictions.

IB involves operations, balance sheet structures, and risks that differ from their conventional banking counterparts.

The directors expressed support for staff’s proposed approach to developing and providing policy advice on Islamic Banking-related issues in the context of the fund’s surveillance, programme design, and capacity development activities.

They also called for staff’s continued support to the work of the relevant international standard setters and other international bodies to help address current gaps in the international regulatory framework for Islamic Banking.

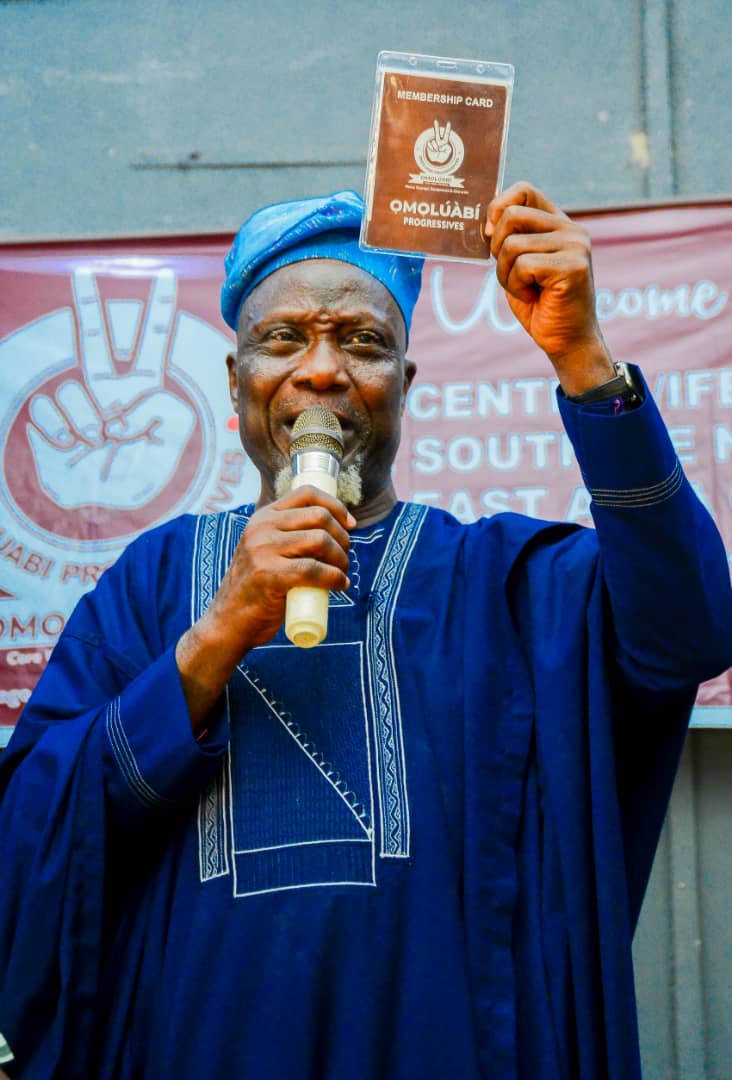

The directors saw merit in considering a proposal to formally recognise the “Core Principles for Islamic Finance Regulation for Banking,” prepared by the Islamic Financial Services Board, as a standard under the Fund/Bank Standards and Codes Initiative.

They looked forward to receiving a formal proposal for the board’s endorsement in the context of a paper before end-April 2018. The directors welcomed the progress that has been made in developing legal and governance frameworks, and regulatory and supervisory standards for Islamic Banking.

Reacting to the report, Prof Binta Tijjani Jibril, Director, International Institute of Islamic Banking and Finance, Bayero University Kano, said the recognition and endorsement by IMF and the World Bank is a testimony to the robustness of the system and its viability as a potent tool for economic development through financial inclusion and poverty reduction.

“It also underscores the fact that though the system is Islamic, its fruits can be enjoyed by both Muslims and non-Muslims alike. Islamic Finance is simply an alternative system of finance with global appeal that has proved its relevance and resilience over the years.

“Our hope is that the Nigerian government will seize this opportunity and tap into the potential of Islamic Finance to help it address the challenges of economic development as compounded by the current recession,” she added.

VON